Page 20 - 2021 - Q3 - Minerva in Focus

P. 20

GHG EMISSIONS: NEW REQUIREMENTS FOR SHIPPING

Shipping and the EU Emissions

Trading System

The shipping industry is set to be includ-

ed in the EU Emissions Trading System (EU

ETS), Europe’s flagship decarbonisation

mechanism, from January 2023. This move

is a watershed moment for the industry

and will have considerable financial im-

plications across charter rates, vessel val- We are everywhere and we take you forward

ues, and equity prices. Over the last three

years, shipping has accounted for around www.aeromet.gr

5.5% of total ETS-covered emissions and,

assuming today’s EUA prices, have cost

$5.6 billion annually.

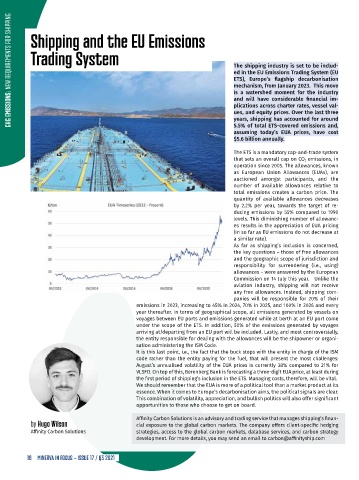

The ETS is a mandatory cap-and-trade system

that sets an overall cap on CO 2 emissions, in

operation since 2005. The allowances, known

as European Union Allowances (EUAs), are

auctioned amongst participants, and the

number of available allowances relative to

total emissions creates a carbon price. The

quantity of available allowances decreases

by 2.2% per year, towards the target of re-

ducing emissions by 55% compared to 1990

levels. This diminishing number of allowanc-

es results in the appreciation of EUA pricing

(in so far as EU emissions do not decrease at

a similar rate).

As far as shipping’s inclusion is concerned,

the key questions – those of free allowances

and the geographic scope of jurisdiction and

responsibility for surrendering (i.e., using)

allowances – were answered by the European

Commission on 14 July this year. Unlike the

aviation industry, shipping will not receive

any free allowances. Instead, shipping com-

panies will be responsible for 20% of their

emissions in 2023, increasing to 45% in 2024, 70% in 2025, and 100% in 2026 and every

year thereafter. In terms of geographical scope, all emissions generated by vessels on

voyages between EU ports and emissions generated while at berth at an EU port come

under the scope of the ETS. In addition, 50% of the emissions generated by voyages

arriving at/departing from an EU port will be included. Lastly, and most controversially,

the entity responsible for dealing with the allowances will be the shipowner or organi-

sation administering the ISM Code.

It is this last point, i.e., the fact that the buck stops with the entity in charge of the ISM

code rather than the entity paying for the fuel, that will present the most challenges:

August’s annualised volatility of the EUA prices is currently 38% compared to 21% for

VLSFO. On top of this, Berenberg Bank is forecasting a three-digit EUA price, at least during

the first period of shipping’s inclusion in the ETS. Managing costs, therefore, will be vital.

We should remember that the EUA is more of a political tool than a market product at its Air Sea Road

essence. When it comes to Europe’s decarbonisation aims, the political signals are clear. Freight Freight

This combination of volatility, appreciation, and bullish politics will also offer significant Transport

opportunities to those who choose to get on board.

Affinity Carbon Solutions is an advisory and trading service that manages shipping’s finan-

by Hugo Wilson cial exposure to the global carbon markets. The company offers client-specific hedging

Affinity Carbon Solutions strategies, access to the global carbon markets, database services, and carbon strategy Riga Ferraiou 73 & Sokratous 26, Moschato

development. For more details, you may send an email to carbon@affinityship.com

Telephone: +30 210 94 15 316 Fax: +30 210 45 33 910 E-mail: info@aeromet.gr

18 MINERVA IN FOCUS – ISSUE 17 / Q3 2021

Aeromet.indd 1 22/9/20 10:23 AM